Environment friendly monetary administration is essential for enterprise and private success. As expertise continues to evolve, synthetic intelligence has emerged within the accounting business, providing modern options to streamline processes, cut back errors, and supply useful insights.

This text explores the highest AI accounting instruments which can be altering how companies deal with their funds. From automating routine duties to offering real-time analytics, these cutting-edge platforms are designed to reinforce accuracy, save time, and empower monetary decision-making. Whether or not you are a small enterprise proprietor, a freelancer, or an accounting skilled, these AI-powered instruments provide a variety of options to fulfill numerous wants and rework monetary administration practices.

Vic.ai is a sophisticated AI-powered accounting device that revolutionizes accounts payable processes. By leveraging subtle machine studying algorithms, Vic.ai automates and streamlines numerous finance duties, with a specific concentrate on accounts payable. The platform’s clever system can robotically ingest, classify, and course of invoices with distinctive accuracy, considerably lowering the necessity for handbook knowledge entry and nearly eliminating human errors within the course of.

Certainly one of Vic.ai’s standout options is its skill to imitate human decision-making, enabling it to handle the complete accounts payable workflow from begin to end autonomously. This functionality permits finance groups to shift their focus from routine duties to extra strategic actions similar to monetary evaluation, money movement forecasting, and vendor relationship administration. Vic.ai’s steady studying mechanism ensures that the AI adapts to every group’s distinctive processes and necessities over time, resulting in more and more environment friendly and correct operations.

Key options:

- Autonomous bill processing that enhances productiveness by as much as 355%

- AI-driven PO matching that detects discrepancies and ensures exact matching

- Streamlined approval workflows that cut back handbook effort and speed up bill approvals

- Clever fee processing that identifies early fee reductions and minimizes fraud dangers

- Actual-time analytics and insights on invoices, crew efficiency, and enterprise traits to help data-driven resolution making

Invoice is a complete cloud-based accounting software program designed to optimize accounts payable and accounts receivable processes for companies of all sizes. The platform harnesses the facility of AI and machine studying to simplify bill administration, streamline approval workflows, and automate fee processing. By doing so, Invoice considerably reduces the time spent on monetary duties whereas minimizing errors that usually happen in handbook processes.

Certainly one of Invoice’s main strengths lies in its seamless integration capabilities with widespread accounting techniques, guaranteeing real-time knowledge synchronization and offering enhanced visibility into monetary operations. The platform’s user-friendly interface, coupled with its customizable choices, makes it a sexy alternative for companies seeking to modernize their monetary processes. Invoice empowers organizations to achieve higher management over their money movement, strengthen vendor relationships, and allocate extra sources to strategic initiatives slightly than routine monetary duties.

Key options:

- Streamlined bill administration that automates bill seize, knowledge entry, and categorization

- Customizable approval workflows that enable setup of multi-level approval processes

- Versatile fee choices supporting numerous strategies together with ACH, EFT, digital playing cards, and checks

- Worldwide fee processing enabling transactions in over 130 nations

- Seamless integration with widespread accounting software program like QuickBooks, Xero, and NetSuite

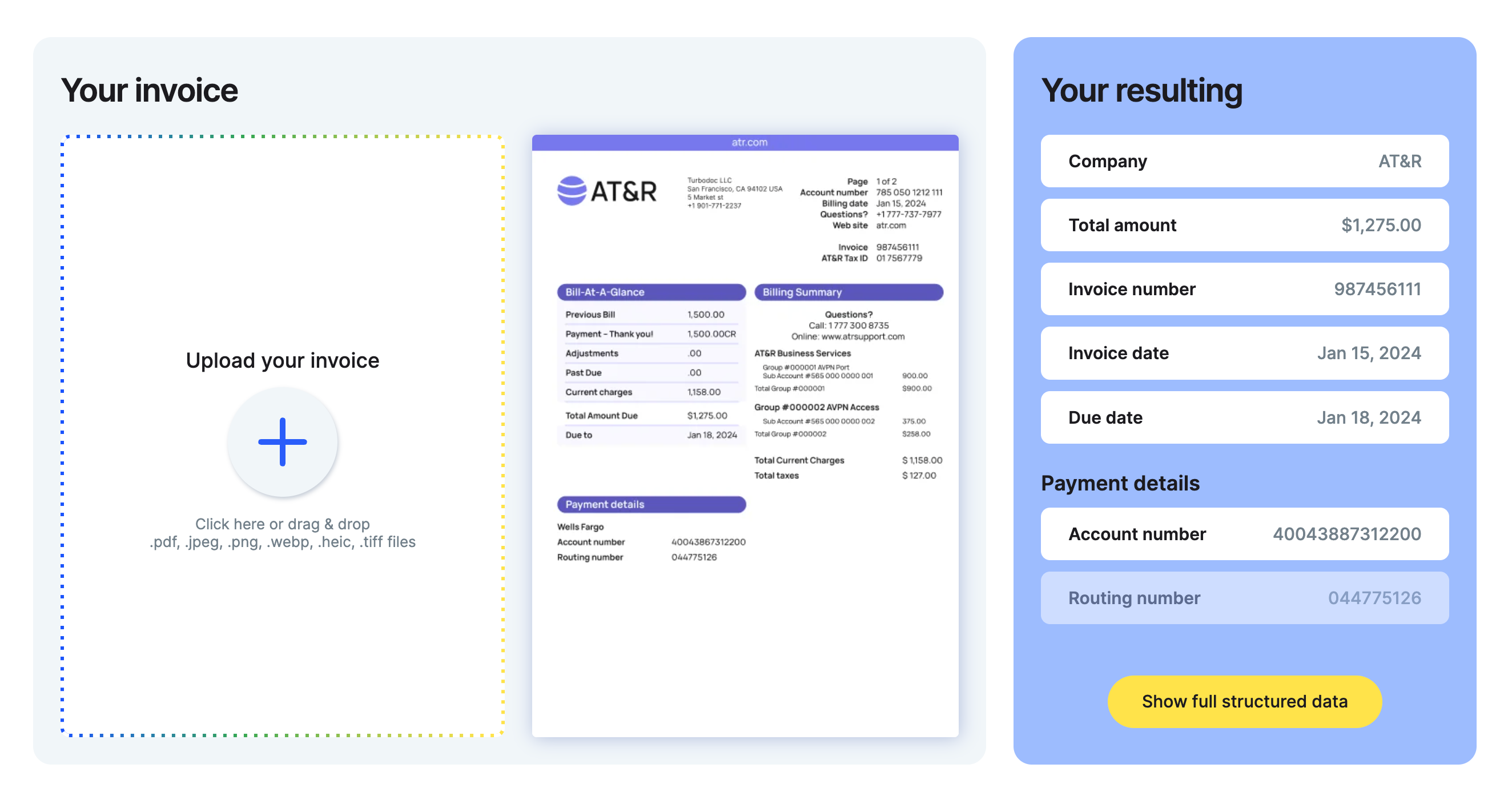

TurboDoc is an modern AI-powered accounting device that focuses on automating bill and receipt processing. The platform leverages cutting-edge optical character recognition (OCR) expertise to precisely extract knowledge from paperwork in numerous codecs. This superior functionality eliminates the necessity for handbook knowledge entry, considerably lowering the effort and time required for processing monetary paperwork whereas concurrently minimizing the danger of human error.

Past its core OCR performance, TurboDoc affords a user-friendly interface that organizes extracted info in an intuitive method. This characteristic permits companies to effortlessly analyze knowledge, assemble stories, and examine monetary info throughout totally different durations or classes. TurboDoc’s emphasis on knowledge safety is obvious in its use of enterprise-level encryption to guard delicate monetary info. Moreover, the platform’s seamless integration with widespread electronic mail companies like Gmail permits customers to automate doc processing immediately from their inboxes, streamlining workflow and enhancing total productiveness.

Key options:

- Superior OCR expertise that processes paperwork in a mean of 1.2 seconds per web page

- Excessive-accuracy knowledge extraction with a 96% accuracy fee

- Seamless Gmail integration for automated doc processing from inboxes

- Person-friendly dashboard for straightforward knowledge evaluation and report meeting

- AES256 enterprise-level encryption for safe knowledge storage on USA-based servers

Indy is a complete productiveness platform meticulously designed to cater to the distinctive wants of freelancers and unbiased professionals. Whereas not solely an accounting device, Indy affords a sturdy suite of monetary administration options alongside different important enterprise features. This all-in-one strategy permits freelancers to handle numerous points of their enterprise, together with proposals, contracts, invoicing, time monitoring, job administration, and shopper communication, all from a single, user-friendly interface.

Certainly one of Indy’s most compelling attributes is its affordability, making it an accessible choice for freelancers at numerous phases of their profession. The platform affords a free plan with important options, in addition to competitively priced paid plans that present entry to extra superior instruments. Indy’s intuitive design and ease of use make it a sexy alternative for freelancers who need to effectively handle their enterprise funds with out the necessity for in depth coaching or a steep studying curve. By consolidating a number of enterprise features into one platform, Indy helps freelancers save useful time and keep organized, permitting them to focus extra on their core enterprise actions and shopper relationships.

Key options:

- Customizable proposal and contract templates with authorized vetting

- Built-in invoicing and fee processing by way of widespread gateways

- Time monitoring device for recording billable hours

- Mission administration options for job group

- Constructed-in shopper communication and file sharing capabilities

Docyt is a state-of-the-art AI-powered accounting automation platform designed to enhance monetary administration for small companies and accounting professionals. By harnessing the facility of superior generative AI capabilities, Docyt automates a variety of accounting processes, together with knowledge seize, workflow administration, and real-time reconciliation. This complete strategy gives companies with unprecedented visibility and precision of their monetary operations, enabling extra knowledgeable decision-making primarily based on up-to-date and correct monetary insights.

On the core of Docyt’s performance are its clever algorithms, which possess the flexibility to learn and perceive bills with human-like comprehension. This superior expertise precisely extracts info from receipts and invoices, categorizing transactions with a excessive diploma of confidence. Docyt’s cutting-edge platform permits true real-time accounting, a characteristic that units it other than many conventional accounting options. Moreover, Docyt seamlessly integrates with current accounting techniques, guaranteeing a easy transition and minimal disruption to established processes. The platform’s user-friendly interface, mixed with its highly effective automation options, positions Docyt as a game-changer in the way in which companies handle their accounting features.

Key options:

- AI-driven knowledge seize from receipts, invoices, and different monetary paperwork

- Automated accounting workflows for duties like bill processing and approval routing

- Actual-time monetary knowledge reconciliation for up-to-date info entry

- Complete monetary insights and reporting capabilities

- Seamless integration with current accounting techniques and enterprise instruments

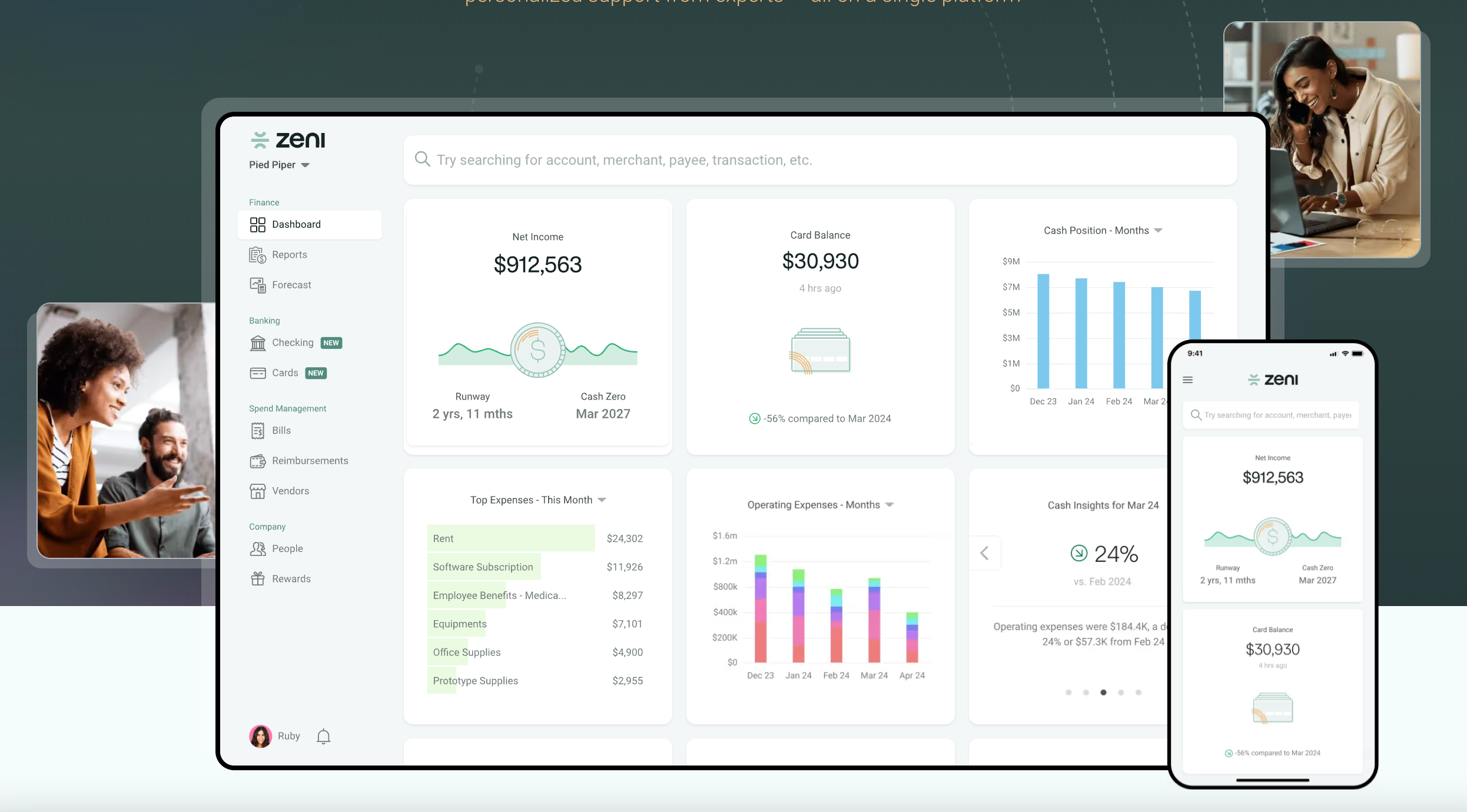

Zeni is an modern AI-powered finance platform that mixes clever bookkeeping, accounting, and CFO companies to streamline monetary operations for startups and small companies. By leveraging superior AI expertise, Zeni automates a big selection of handbook processes, offering real-time insights and providing customized help from a devoted crew of finance consultants. This complete strategy permits companies to replace their books each day, entry real-time monetary knowledge, and make knowledgeable selections primarily based on correct, up-to-date info.

Certainly one of Zeni’s key strengths lies in its skill to offer an entire monetary answer on a single platform. From invoice pay and invoicing to expense administration and monetary planning, Zeni affords a variety of companies to fulfill the various wants of rising companies. The platform’s user-friendly interface, coupled with skilled help from a devoted finance crew, makes it a sexy alternative for entrepreneurs and enterprise house owners seeking to optimize their monetary operations and concentrate on progress. By consolidating a number of important instruments into one bundle, Zeni helps companies lower your expenses and simplify their expertise stack, offering a cheap answer for complete monetary administration.

Key options:

- AI-powered bookkeeping that robotically categorizes transactions and reconciles accounts

- Complete monetary companies together with invoice pay, invoicing, and expense administration

- Actual-time monetary insights and customizable reporting capabilities

- Entry to a devoted crew of finance consultants, together with bookkeepers, accountants, and CPAs

- Seamless integration with widespread enterprise instruments and platforms

Blue dot is an AI-driven tax compliance platform designed to handle the complexities of contemporary worker spend administration. With the rise of hybrid work environments, decentralized buying, and on-line consumption, employee-triggered transactions have develop into more and more prevalent, posing challenges for finance groups coping with unstructured monetary knowledge. Blue dot’s platform tackles these points by offering complete protection in each VAT and taxable worker profit areas.

The platform’s expertise leverages superior AI algorithms and machine studying to digitize tax compliance, automating numerous monetary processes whereas lowering handbook effort and guaranteeing accuracy. Blue dot affords optimized VAT outcomes by figuring out eligible and certified VAT spend in compliance with nation tax laws and firm insurance policies, guaranteeing correct home VAT posting and international VAT refunds. Moreover, the platform automates the evaluate of consumer-style spend topic to taxable worker advantages, guaranteeing compliance with wage taxation and pay-as-you-earn reporting necessities. By combining these options with an robotically up to date tax data base and configurable rule engines, Blue dot gives a sturdy answer for contemporary tax compliance challenges.

Key options:

- Good automation of monetary processes for enhanced accuracy and audit preparedness

- Optimized VAT outcomes by way of AI-driven identification of eligible spend

- Automated evaluate of taxable worker advantages for wage taxation compliance

- Constantly up to date tax data base with configurable rule engines

- Superior AI and ML capabilities leveraging deep studying and pure language processing

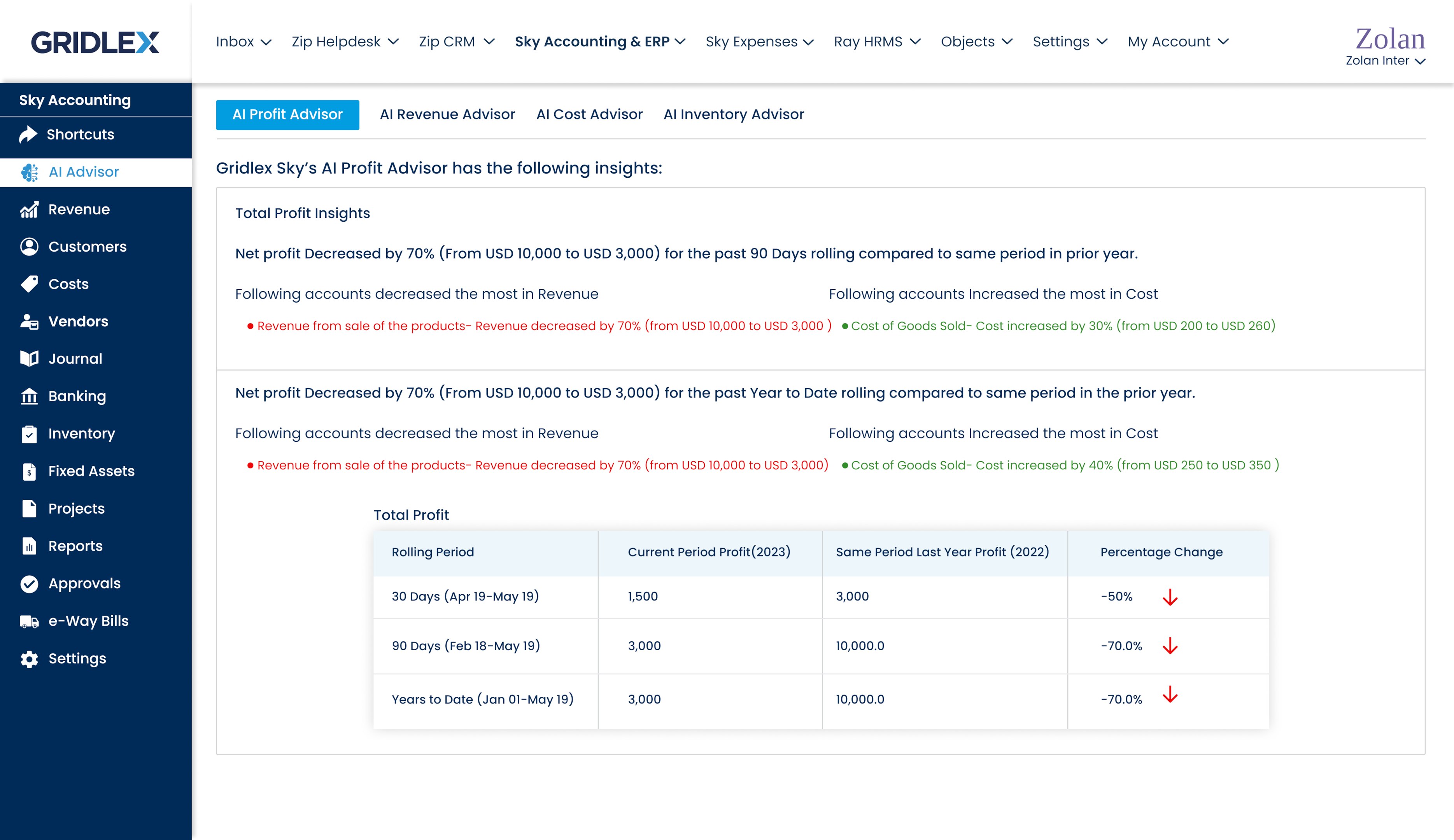

Gridlex is a flexible, all-in-one app builder designed to streamline operations and increase productiveness throughout numerous industries. Whereas not solely an accounting device, Gridlex affords a complete suite of options that features CRM, customer support, assist desk ticketing, grasp knowledge administration, and operations administration. The platform’s ultra-customizable nature permits organizations to configure the app builder to fulfill their particular wants, guaranteeing a tailor-made answer that addresses distinctive enterprise challenges.

Certainly one of Gridlex’s standout options is its accounting and ERP module, Gridlex Sky. This part permits companies to handle their funds successfully, providing capabilities similar to invoicing, invoice administration, and financial institution reconciliation. By automating monetary processes, lowering handbook calculations, and simplifying expense claims, Gridlex Sky considerably enhances accounting effectivity. The platform’s AI-driven insights assist companies analyze their monetary knowledge, facilitating knowledgeable decision-making and strategic planning. Moreover, Gridlex’s skill to consolidate a number of important instruments right into a single, cost-effective bundle helps companies lower your expenses and simplify their expertise stack, making it a sexy choice for organizations seeking to streamline their operations.

Key options:

- Complete accounting and ERP performance by way of Gridlex Sky module

- AI-powered monetary insights for knowledge evaluation and strategic planning

- Multi-currency transaction dealing with for world enterprise operations

- Built-in stock administration for environment friendly monitoring and optimization

- Constructed-in timesheet and HR software program for streamlined workforce administration

Truewind is an AI-powered accounting and finance platform particularly designed to streamline bookkeeping and monetary administration for startups and small to medium-sized companies (SMBs). By harnessing the facility of generative AI applied sciences, Truewind automates routine accounting duties, delivers correct and well timed monetary stories, and affords strategic insights to help enterprise progress. The platform’s strategy combines AI-driven processes with skilled human oversight, leading to a complete, environment friendly, and dependable monetary administration answer.

On the core of Truewind’s choices are AI-powered bookkeeping, month-end shut automation, and CFO companies. The platform seamlessly integrates with widespread accounting software program similar to QuickBooks, NetSuite, and Xero, guaranteeing a easy transition and minimal disruption to current processes. Truewind’s dedication to knowledge safety and privateness is obvious in its adherence to the very best requirements, together with SOC 2 certification and strict knowledge privateness insurance policies. This mix of cutting-edge AI expertise, human experience, and strong safety measures positions Truewind as a strong device for companies looking for to optimize their monetary operations and drive progress.

Key options:

- AI-powered bookkeeping for quicker and extra correct monetary record-keeping

- Automated month-end shut course of to speed up monetary reporting

- CFO companies offering strategic insights and forecasting for enterprise progress

- Seamless integration with widespread accounting software program platforms

- SOC 2 licensed knowledge safety and strict privateness insurance policies

Booke is an modern AI-powered bookkeeping automation platform designed to streamline monetary processes for companies and accounting professionals. By leveraging superior AI applied sciences similar to Robotic Course of Automation (RPA) and Generative AI, Booke automates time-consuming duties like transaction reconciliation and categorization, considerably lowering handbook workload and enhancing accuracy. The platform’s clever algorithms excel at extracting knowledge from monetary paperwork in real-time, guaranteeing that monetary data are all the time up-to-date and exact.

Certainly one of Booke’s key strengths lies in its seamless integration capabilities with widespread accounting software program similar to Xero, QuickBooks, and Zoho Books. This integration ensures a easy workflow and minimizes disruption to current processes, making it an excellent answer for companies seeking to improve their monetary operations with out overhauling their whole system. Booke’s user-friendly interface, mixed with its highly effective automation options, considerably improves effectivity and accuracy in monetary administration. By automating each day and month-end bookkeeping processes, together with categorizing and matching financial institution feed transactions with corresponding payments, invoices, and receipts, Booke permits finance professionals to concentrate on extra strategic duties, in the end resulting in improved shopper satisfaction and enterprise progress.

Key options:

- AI-driven automation of transaction reconciliation and categorization

- Actual-time knowledge extraction from monetary paperwork for up-to-date data

- Seamless integration with widespread accounting software program platforms

- Automated each day and month-end bookkeeping processes

- Enhanced effectivity and accuracy in monetary administration duties

Why Use an AI Accounting Software?

The speedy evolution of AI accounting instruments has reworked the panorama of monetary administration, providing unprecedented benefits to companies of all sizes. These modern options streamline accounting processes, lowering the effort and time required for routine duties similar to knowledge entry and transaction categorization. By automating these mundane actions, AI instruments liberate accounting professionals to concentrate on extra strategic points of monetary reporting and evaluation, in the end including extra worth to their organizations or purchasers.

One of the crucial important advantages of AI accounting instruments is their skill to offer real-time monetary insights. In contrast to conventional strategies that usually depend on periodic reporting, these superior platforms provide up-to-the-minute knowledge on an organization’s monetary well being. This rapid entry to correct monetary knowledge empowers decision-makers to reply swiftly to market modifications, determine potential points earlier than they escalate, and capitalize on rising alternatives. Furthermore, the improved accuracy of AI-driven monetary stories minimizes the danger of errors that may result in pricey errors or compliance points.

Because the accounting business continues to embrace technological developments, AI instruments have gotten indispensable for sustaining a aggressive edge. These platforms not solely enhance effectivity and accuracy but in addition improve the general high quality of monetary companies offered by accounting companies. By leveraging AI of their each day operations, accountants can provide extra complete and insightful monetary evaluation, strengthening their position as trusted advisors to their purchasers. Finally, the adoption of AI accounting instruments represents a strategic funding in the way forward for monetary administration, promising to ship long-term advantages by way of productiveness, accuracy, and decision-making capabilities.